The 10-Minute Rule for Eb5 Investment Immigration

The 10-Minute Rule for Eb5 Investment Immigration

Blog Article

Not known Facts About Eb5 Investment Immigration

Table of ContentsThe 8-Minute Rule for Eb5 Investment ImmigrationThe 20-Second Trick For Eb5 Investment ImmigrationThe Basic Principles Of Eb5 Investment Immigration Not known Facts About Eb5 Investment ImmigrationThe 10-Minute Rule for Eb5 Investment Immigration

While we aim to use precise and current web content, it should not be thought about legal recommendations. Migration laws and policies go through change, and specific scenarios can vary commonly. For individualized advice and legal recommendations concerning your details migration situation, we highly advise speaking with a certified migration lawyer that can give you with customized help and make sure conformity with present legislations and policies.

Citizenship, through investment. Presently, since March 15, 2022, the quantity of investment is $800,000 (in Targeted Work Locations and Rural Areas) and $1,050,000 in other places (non-TEA areas). Congress has authorized these amounts for the next five years starting March 15, 2022.

To get the EB-5 Visa, Investors must develop 10 full-time U.S. tasks within 2 years from the day of their complete investment. EB5 Investment Immigration. This EB-5 Visa Requirement makes certain that financial investments add directly to the U.S. job market. This applies whether the jobs are created directly by the company or indirectly under sponsorship of a marked EB-5 Regional Center like EB5 United

Examine This Report on Eb5 Investment Immigration

These jobs are figured out via versions that use inputs such as development costs (e.g., construction and equipment expenses) or annual incomes generated by ongoing procedures. In contrast, under the standalone, or straight, EB-5 Program, only straight, permanent W-2 employee positions within the company may be counted. A crucial threat of counting only on straight employees is that team decreases as a result of market conditions could result in inadequate full-time positions, possibly causing USCIS denial of the capitalist's request if the job production requirement is not met.

The economic version then projects the variety of straight tasks the brand-new business is most likely to develop based upon its expected incomes. Indirect jobs calculated through financial versions refers to work created in markets that supply the goods or services to the business straight entailed in the job. These work are produced as a result of the raised need for products, materials, or services that sustain the service's operations.

Some Ideas on Eb5 Investment Immigration You Need To Know

An employment-based 5th choice classification (EB-5) investment visa supplies a method of ending up being an irreversible U.S. citizen for foreign nationals wanting to invest funding in the United States. In order to obtain this environment-friendly card, a foreign financier needs to invest $1.8 million (or $900,000 in a Regional Facility go to website within a "Targeted Work Area") and create or protect a minimum of 10 full time work for USA employees (leaving out the financier and their instant family members).

This procedure has been a remarkable success. Today, 95% of all EB-5 capital is increased and spent by Regional Centers. Because the 2008 monetary crisis, accessibility to capital has been restricted and metropolitan budget plans remain to face significant deficiencies. In many regions, EB-5 financial investments have filled the financing gap, supplying a new, crucial source of funding for regional financial growth jobs that renew areas, produce and sustain jobs, facilities, and solutions.

Little Known Facts About Eb5 Investment Immigration.

workers. In addition, the Congressional Budget Plan Office (CBO) racked up the program as profits neutral, with management expenses paid for by candidate costs. EB5 Investment Immigration. Greater than 25 countries, including Australia and the United Kingdom, usage similar programs to attract foreign investments. The American program is a lot more rigid than numerous others, requiring considerable risk for capitalists in terms of both their economic investment and immigration condition.

Households and individuals who seek to relocate to the United States on a permanent basis can apply for the EB-5 Immigrant Financier Program. The USA Citizenship and Immigration Solutions (U.S.C.I.S.) laid Website out numerous needs to get long-term residency with the EB-5 visa program. The demands can be summed up as: The capitalist should meet capital expense quantity needs; it is generally needed to make either a $800,000 or $1,050,000 capital expense amount into an U.S.

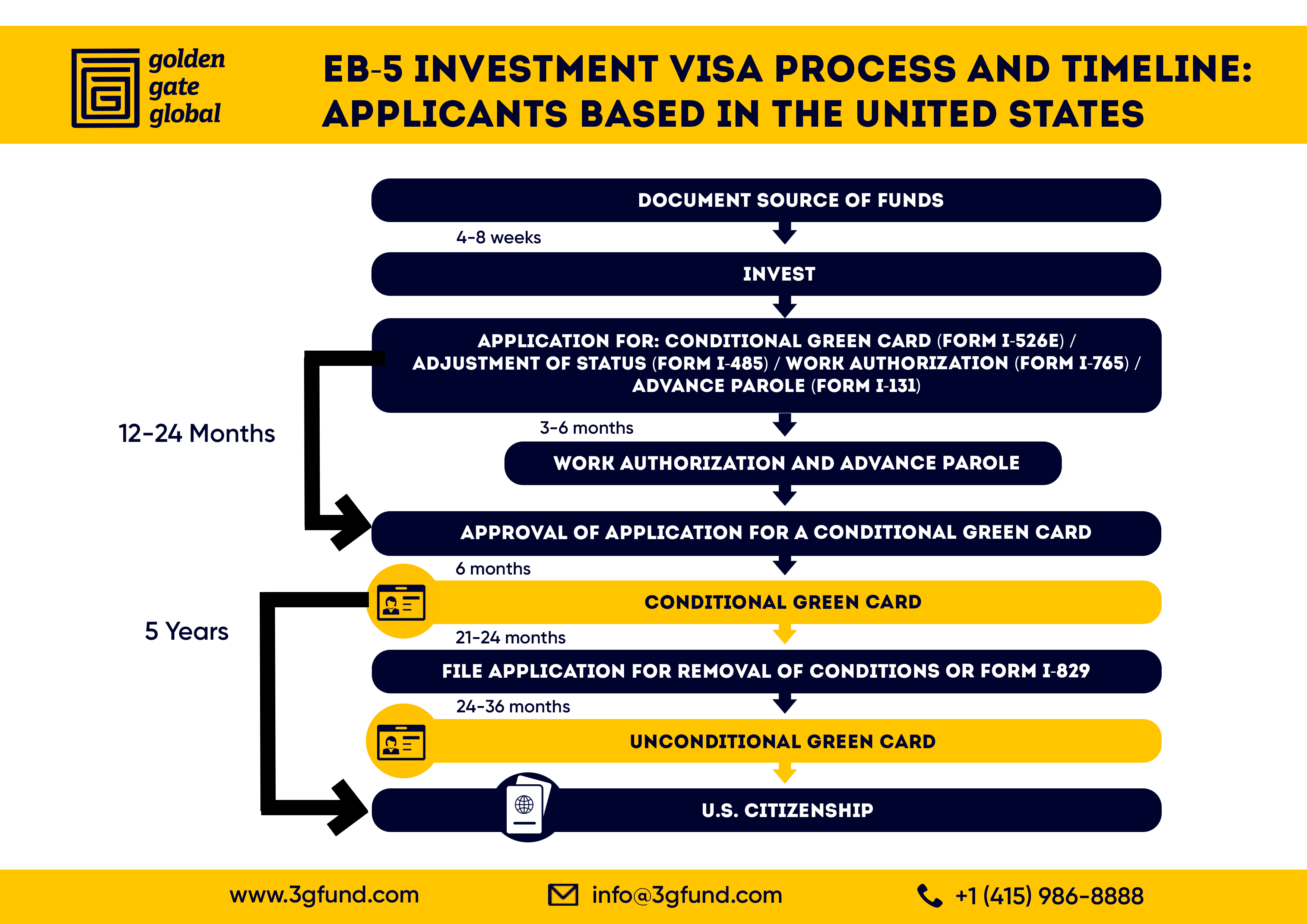

Talk to a Boston immigration attorney concerning your demands. Below are the general actions to acquiring an EB-5 financier eco-friendly card: The initial action is to locate a qualifying investment opportunity. This can be a brand-new industrial venture, a regional facility task, or an existing service that will be expanded or reorganized.

Once the chance has actually been determined, the capitalist needs to make the financial investment and send an I-526 petition to the U.S. Citizenship and Migration Services (USCIS). This request should include evidence of the investment, such as bank declarations, purchase agreements, and organization plans. The USCIS will examine the I-526 application and either authorize it or demand added evidence.

Not known Facts About Eb5 Investment Immigration

The investor has to make an application for conditional residency by submitting an I-485 petition. This petition must be submitted within 6 months of the go to my site I-526 authorization and have to consist of evidence that the investment was made and that it has actually developed at the very least 10 permanent work for united state workers. The USCIS will certainly examine the I-485 petition and either approve it or request added proof.

Report this page